Have you ever gotten into a heated argument over an innocent comment you made? Now imagine what it must be like to have to make a major financial decision in that highly agitated frame of mind. Let us help you avoid what could be a costly mistake.

Paperwork Matters

Caring for someone with Alzheimer’s is stressful, painful, and expensive. Make sure you recognize the warning signs and obtain valid legal signatures before it is too late.

The Power of a Visionary

To transition from vision to action, you need a plan. Would you bet your retirement on the details and execution contained in your existing retirement plan?

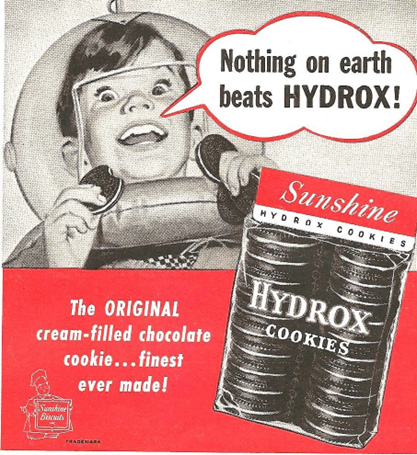

What Happened to my Hydrox Cookies?

Growing up, I loved Hyrdox cookies and milk. According to Wikipedia,” the cookie’s creation was inspired by “purity and goodness”, with a name derived from the hydrogen and oxygen elements within the water molecule.” For me, it was more than a snack; it was a ritual. Every day I would dunk the cookie until it got soggy. So many happy memories. And so many pounds. Did you know that Oreo was created in 1912, 4 years after the launch of Hydrox? During those young years, if Hydrox was a stock, I would have put all my money in it. As …

Verbal Sparring

When my wife and I started our business, we fought a lot. And we fought hard. We both wanted our venture to be successful. But damn, we couldn’t get 3 minutes into a discussion before the gloves came off. Every time we sat down to talk, ding, round 100. The winner is the last spouse standing. Something had to change. At my suggestion, we adopted a new approach to our discussion. Whenever the discussion becomes heated, either one of us calls out to Alexa to start a timer. The person who starts the timer then has the option to either: …

What We Think is Right is Not Necessarily So

Election day, 2008. On my way to vote, I unknowingly fell victim to a detached retina in my left eye. The damage was irreversible. As a result, I began to unconsciously adjust myself to accommodate my new reality. Soon I became unstable as my posture began to deteriorate. I became stoop-shouldered. My golf game, which was in no great shape to begin with, began to suffer; I was spraying the ball everywhere and lost 20 yards of distance. Frustrated, I started making more adjustments. They felt good for me. And my golf game started to improve. Briefly. I continued to …

Importance of Attitude

Ever buy a stock with high expectations only to sell it shortly thereafter? Only then to find out you were right in the first place. Don’t let frustration talk you out of a good idea.

Embrace Failure

“Failure is success in progress.” – Albert Einstein In 2023 I set a goal for myself, to re-invent my golf swing and break 90. After selecting a golf instructor whose teaching style and philosophy appealed to me, watching countless (who am I kidding, 73) hours of videos and standing in front of a mirror with a golf club ‘practicing’, I was ready for the range. It was already June, and I hadn’t hit a golf ball. My practice objectives were to make solid contact and minimize dispersion with zero defects. When I hit ‘em good I was very very good, …

Understanding Your Attitudes Toward Money and Building a Financial Plan

Tutor Financial’s Michael Lewis recently sat down with Triangle 411 host Mary Insprucker to shed light on his behavioral finance-based approach to financial planning. Working with clients to understand their individual attitudes towards finances and wealth, Michael can suggest opportunities that are synergistic with the client’s risk profile, as well as their dreams for achieving their best life. Click the player below to listen. Contact Michael today to learn more about how your own behavior modifications can impact your financial planning opportunities.

Video: The Cost of Being Stubborn

Our minds can help us when it comes to matters of basic survival. Unfortunately, when it comes to making decisions with money, our brains sabotage us. Fortunately, there are ways around this natural tendency. Learn more… Want to learn more about how your behaviors may be impeding your financial success? Click here to take a brief 5 minute questionnaire. Upon completion, the results will be immediately emailed to you.